New Delhi, 14 August 2025:

My Journey from Debt to Financial Independence

Embarking on a mutual fund investment journey can feel overwhelming, yet it can lead to financial freedom with the right approach. My own journey started on 19 June 2008, evolving over the past three decades from a spendthrift lifestyle to managing an admirable retirement portfolio. Today, I’ll share insights from this transformative experience, shedding light on both the successes and challenges encountered along the way.

The Genesis of My Investment Story

For new investors eager to embark on their journey, I often refer them to my earlier pieces: The Financial Arrow of Time and My Journey: Driven by the Fear of Making the Same Mistakes Again. These articles, along with my feature in Livemint, encapsulate my evolving perspective as an investor. While many may keep their experiences private, it’s essential to acknowledge that numerous individuals have navigated similar paths.

My narrative is not a ground-breaking saga but reflects an everyday reality faced by several investors. From starting in debt to achieving a sense of financial independence, I learned invaluable lessons about the investment landscape—lessons I continue to emphasize today.

Current Portfolio Growth and Insights

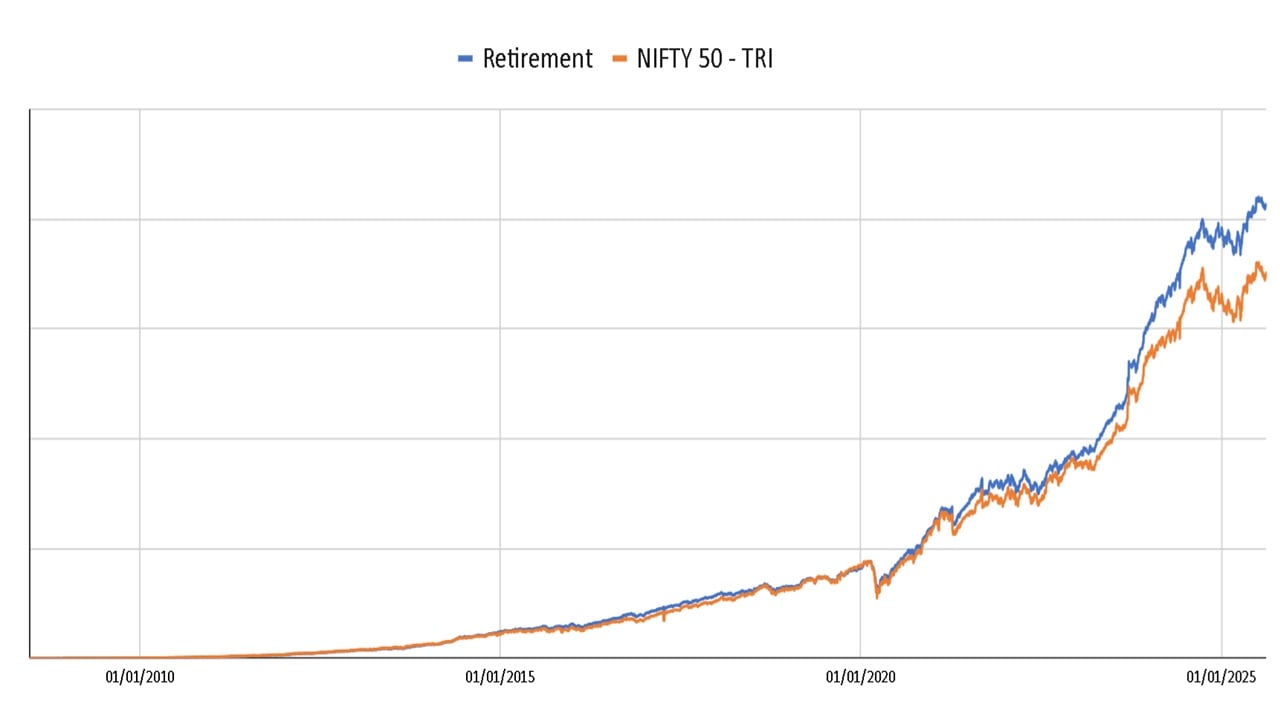

As of 14 August 2025, my retirement portfolio showcases significant growth compared to identical purchases and redemptions in the Nifty 50 TRI index. This growth can be tracked using free tools like the Mutual Funds and Stock Portfolio Tracker from Freefincal.

Analyzing my asset allocation, the equity mutual fund portfolio indicates robust performance with top funds such as Parag Parikh FlexiCap, boasting an XIRR of 20.36%, and a significant weight of 59.19% in my investments. The debt portfolio similarly highlights strategic choices, like the NPS fund with an XIRR of 9.07%, reflecting a thoughtful diversification strategy.

Growth of my retirement portfolio compared with identical purchases and redemptions in the Nifty 50 TRI index as of 14 August 2025

Reflecting on portfolio growth often leads back to fundamental lessons learned along the way. Keeping my emotions prioritized over market fluctuations allowed me to invest without constant worry.

Key Lessons from My Investment Journey

As I evaluate my investment philosophy, three critical aspects stand out: Luck, Discipline, and Emotional Management. While luck may play a role, maintaining discipline and a holistic view of my financial goals have been paramount.

- Get a Life! – Identify your goals and invest towards them without constant monitoring.

- Diminish Information Overload – Limit financial groups or contacts that could contribute to unnecessary anxiety.

- Stay Committed – During sideways markets, invest substantively to take advantage of optimal conditions rather than retreating.

Moreover, my experience has taught me that investing is not solely about returns. It’s about approaching investments with the mindset of long-term emotional wellbeing. Recognizing that gains are often notional and leveraging that understanding to navigate potential market downturns has been pivotal.

I also learned that money has a psychological component—its drive increases as wealth grows. Keeping this in check and giving back to the community fosters balance and realism, ensuring compassion stems from capital.

Time and Discipline: The Keys to Financial Freedom

The power of compounding returns is immense, but it requires patience and belief in the process. Understanding that it takes both time and money to grow wealth highlights the significance of consistent investing habits. Aspiring investors should always assess their long-term goals against their spending habits.

My advice for those looking to navigate financial independence is straightforward: Focus on a structured investment plan and stick to it. This could involve regular contributions to mutual funds or tracking portfolios methodically while learning the nuances of financial independence.

This ongoing journey of mutual fund investing has taught me a great deal about fiscal responsibility and emotional resilience. Whether you’re just starting or looking to optimize your existing portfolio, the foundation remains the same: Define your goals, remain disciplined, and invest wisely.

For those eager to continue learning and refining their investment strategies, more trusted updates await. Follow Bankerpedia for comprehensive insights into the banking and finance landscape.

Original source: freefincal.com