Faridabad: In a surprising move, Canara Bank’s Regional Office in Faridabad has mandated that several branches remain operational on Sunday, August 31, 2025, to focus on recovering troubled assets including Non-Performing Assets (NPAs). This decision has sparked a wave of discontent on social media, as bank employees voice concerns over escalating work pressure and diminished work-life balance.

Canara Bank’s Sunday Opening Directive

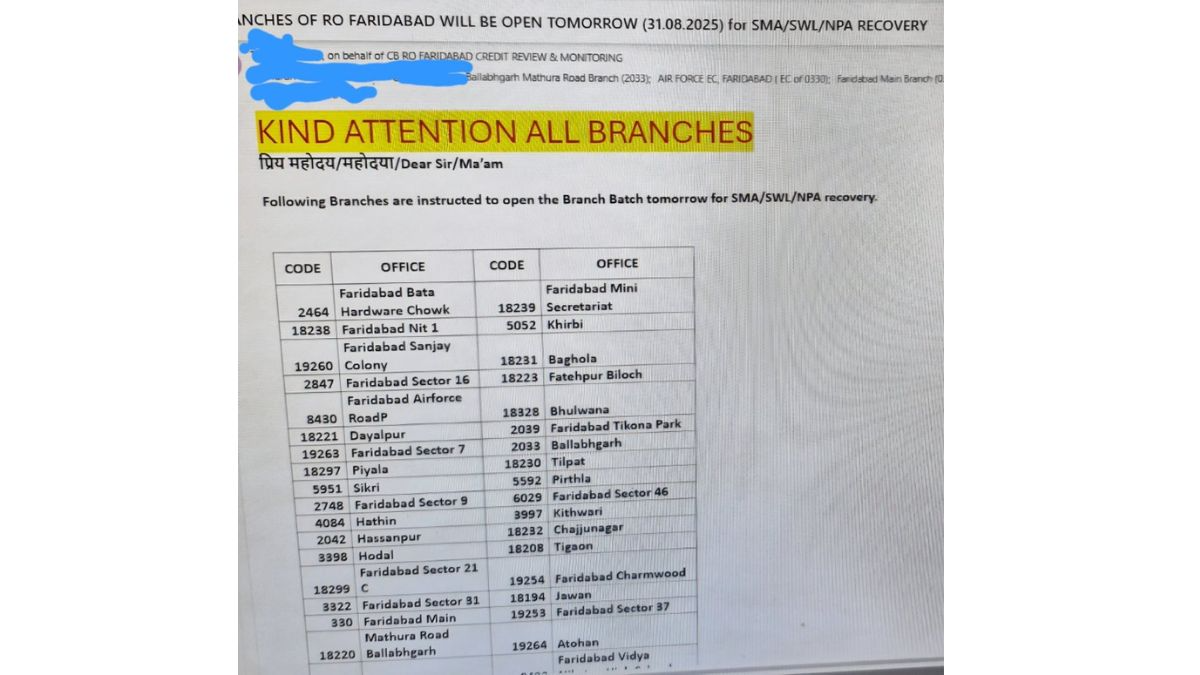

Canara Bank’s recent directive has raised eyebrows, requiring more than 10 branches in Faridabad and its surrounding regions to operate on a Sunday – traditionally a day off for most financial institutions. The branches affected include well-known locations like Bata, Hardware Chowk, and Sector 16. This initiative aims to address Special Mention Accounts (SMA) and Special Watch List (SWL) alongside the more critical task of NPA recovery.

Image: Official circular issued by Canara Bank RO Faridabad listing branches directed to open for NPA recovery on Sunday.

Branch Coverage

The branches outlined in the directive cover a substantial geographic area of Faridabad, ensuring that a multitude of customers can access banking services even on weekends. While banks cite these measures as essential for financial stability, the pressure on employees raises valid concerns about overall well-being and workplace sanity.

A summary of the affected branches by Canara Bank is detailed in the table below:

| Branch Name | Location |

|---|---|

| Bata | Faridabad |

| Hardware Chowk | Faridabad |

| Nit-1 | Faridabad |

| Sanjay Colony | Faridabad |

| Sector 16 | Faridabad |

| Airforce Road | Faridabad |

| Sikri | Faridabad |

| Piyala | Faridabad |

Growing Discontent on Social Media

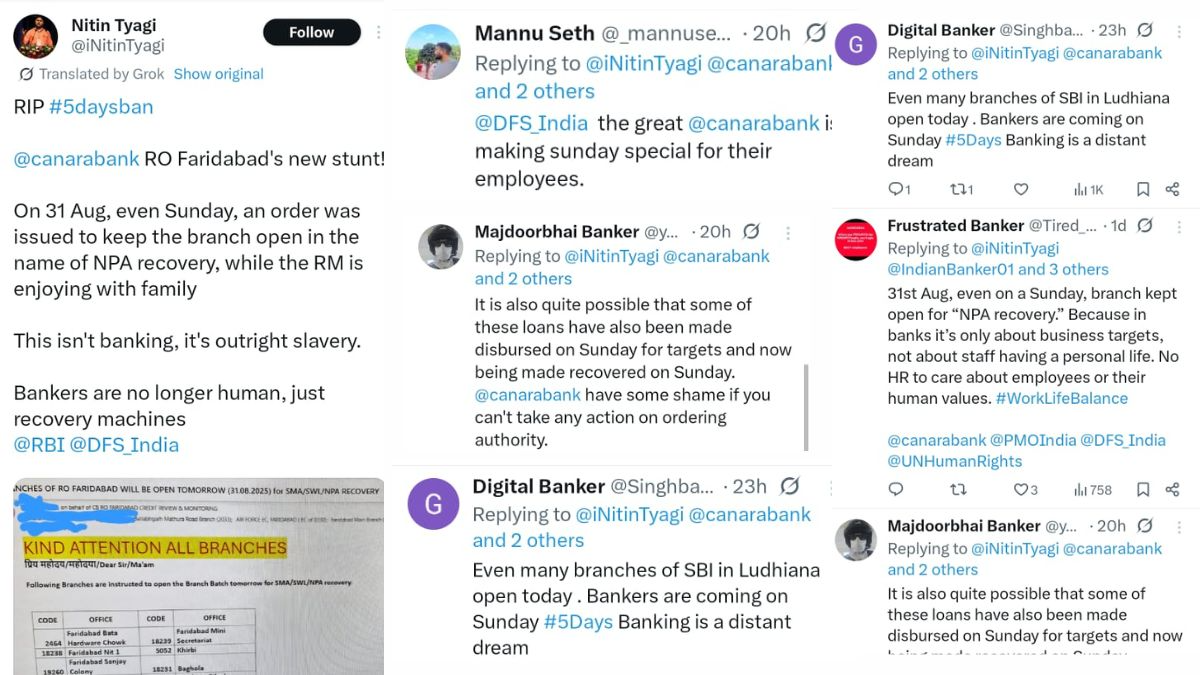

Following the announcement, the social media landscape was quickly flooded with reactions, particularly on Twitter (now X). Employees and banking groups expressed outrage, labeling the requirement as “slavery.” Many highlighted the detrimental impact this directive would have on work-life balance, which is already a pressing concern within the banking sector. Comments from frustrated employees echoed traumatic tales of high stress levels, leading them to question the ethics of enforcing such policies in a rapidly evolving work environment.

Image: Reactions on X

Impact on Work-Life Balance

The recent directive from Canara Bank’s Faridabad branch feeds into a larger debate surrounding work culture in Public Sector Banks (PSBs) across India. Bank employees have long voiced their concerns regarding increased workloads, inconsistent time off, and the pressures of meeting strict performance targets. Many argue that demands for branches to stay open on weekends further undermine any attempts to establish a balanced work-life dynamic.

The call for such Sunday openings is not new; other banks have similarly pressured their staff, indicating a systemic issue that transcends individual institutions. The rising trend of Sunday openings has led to mounting grievances and even calls for reform among banking employees.

Awareness on Employee Well-Being

Recent tragic incidents, such as the suicide of a Canara Bank officer, cast a somber light on the impact of work pressure within the banking space. As financial institutions face increasing challenges related to asset recovery and economic pressures, the mental health of their employees must not be neglected. Media reports discussing these challenges have spurred conversations about whether achieving financial targets should come at the cost of employees’ well-being.

The ongoing wave of demand for change in the banking sector points to the necessity of creating a work environment that values both productivity and health. As instances of stress-related issues continue to surface, the time has come for banking organizations to evaluate their policies critically and prioritize the mental health of their workforce.

In conclusion, Canara Bank’s Sunday opening notice for NPA recovery underscores the complexities facing banking employees. As the industry navigates the road to recovery in a challenging financial landscape, the need for sustainable work practices has never been more critical. Striking the right balance may not only improve employee morale but also enhance the overall performance of the banking sector.

Bankerpedia’s Insight 💡

Canara Bank’s directive to open branches on Sunday for NPA recovery highlights a troubling trend in India’s banking sector – prioritizing performance metrics over employee welfare. This move risks exacerbating work-life balance issues, sparking widespread employee dissatisfaction and mental health concerns. As banks struggle with NPAs, the industry must reconsider management practices that ignore worker well-being. For readers, it’s crucial to engage in dialogue with banking institutions about the importance of a balanced work environment, advocating for reforms that protect employees while ensuring financial stability.

How Does This Affect the Banking Ecosystem? 🏦

- Bank Employees → Increased work pressure and negative impact on work-life balance.

- Bank Management → Increased operational pressure and employee dissatisfaction for management.

- Bank Customers → Bank customers might face reduced service availability and support.

- Investors / Shareholders → Increased operational costs could impact shareholder returns negatively.

- Regulators (RBI, SEBI, Govt.) → Increased scrutiny on banks’ work practices and regulations.

- General Public → Increased banking inconvenience, worsening work-life balance concerns.

Research References 📚

Loved our Research? ❤️

Bankerpedia turns financial confusion into clarity!

Subscribe to our YouTube channel for unbiased insights, financial literacy & practical banking wisdom.