Salt Lake City: On August 19, 2025, UCO Bank’s Salt Lake Zone issued a circular suspending employee leave rights until September 30, prompting concerns over legal precedent and employee welfare. The directive limits Privilege Leave, discourages Casual Leave, and halts Leave Travel Concession (LTC). The suspension raises questions about balancing operational demands with statutory rights, especially as the festive season approaches.

- UCO Bank’s Controversial Leave Suspension Circular

- The Legal Landscape: Leave as a Statutory Right

- The Impact on Employees and Workplace Culture

- Operational Needs vs. Employee Welfare

- What Lies Ahead for UCO Bank?

- Bankerpedia’s Insight 💡

- How Does This Affect the Banking Ecosystem? 🏦

- Research References 📚

- Loved our Research? ❤️

UCO Bank’s Controversial Leave Suspension Circular

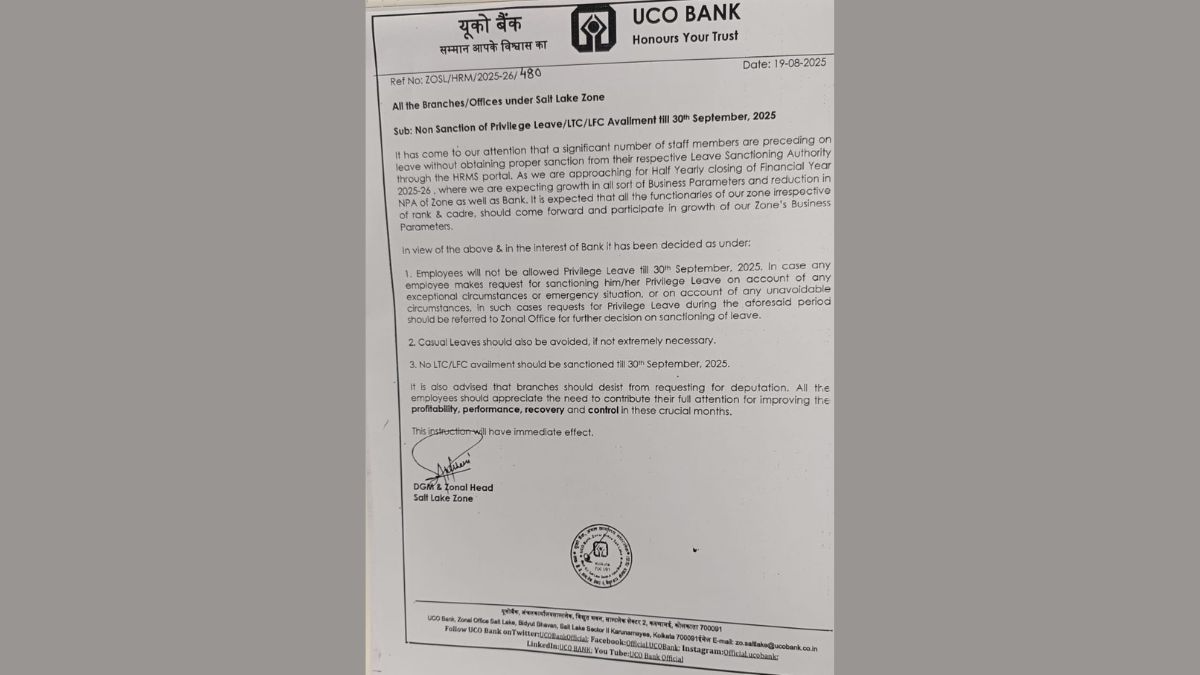

In a bold move that has stirred apprehension among employees, UCO Bank’s Salt Lake Zone issued a controversial circular on August 19, 2025. Citing operational requirements, the directive (Ref No: ZOSL/HRM/2025-26/480) restricts all leave types until September 30, 2025, unless deemed an emergency or requiring Zonal Office approval. Casual Leave should also be avoided unless absolutely necessary, and all Leave Travel Concession (LTC) requests stand suspended during this period.

The Zonal Head emphasized that uninterrupted staff presence is crucial for achieving various business targets, particularly for the half-yearly closing of FY 2025-26. The circular outlines the need for enhanced profit margins, reduced Non-Performing Assets (NPAs), and overall recovery and control in the banking sector.

Image: UCO Bank Salt Lake Zone circular suspending staff leave till September 30, 2025.

The Legal Landscape: Leave as a Statutory Right

While UCO Bank defends the suspension as essential for operational function, the decision casts a shadow on established legal parameters around employee leave. Referencing a landmark judgment in the M/s Glaxo Laboratories (India) Ltd. vs Labour Court, Meerut (1984) case, the Supreme Court ruled that withholding an employee’s earned leave without compelling justification constitutes an unfair labour practice. This ruling reiterates that earned leave is a statutory right and not merely a privilege granted by an employer.

This legal context brings into question whether UCO Bank’s blanket suspension aligns with labour protections. As employees approach the festive season—a time generally associated with family, rest, and personal commitments—the potential infringement on their leave rights has led to considerable concern within the workforce.

The Impact on Employees and Workplace Culture

With the festive season fast approaching, many employees may have made plans that now hang in the balance, creating a palpable tension between personal obligations and professional demands. The extensive strain on employees to maintain performance during this critical business period could inadvertently lead to dissatisfaction and disengagement within the workforce.

To illustrate, consider a hypothetical employee, Priya, a manager at UCO Bank, who was planning a trip with her family to celebrate the festival of lights. The abrupt curtailment of her leave rights not only disrupts her personal plans but also creates an atmosphere of uncertainty and resentment among staff members, who may feel undervalued and overburdened during an essential time of year.

Operational Needs vs. Employee Welfare

The underlying concern associated with this circular centers on striking the right balance between operational efficiency and employee welfare. Public Sector Banks like UCO Bank are tasked with improving profitability, yet the approach to achieving these metrics raises critical questions. Can operational necessities justifiably override employee rights, especially during sensitive periods such as festivals?

Employees and management alike now find themselves in a precarious situation—unable to predict how this decision will impact their work-life balance and overall job satisfaction. As the September closing approaches, attention turns to how UCO Bank’s leadership will navigate this complex terrain while reconciling growth objectives with the humane treatment of its staff.

| Key Facts Related to UCO Bank’s Circular |

|---|

| Date of Circular: August 19, 2025 |

| Suspension Period: Until September 30, 2025 |

| Types of Leave Affected: Privilege Leave, Casual Leave, LTC |

| Legal Precedent: M/s Glaxo Laboratories (1984) |

| Concerns Voiced By: Bankers and Employees |

| Potential Impact: Workplace Discontent |

What Lies Ahead for UCO Bank?

As all eyes remain fixed on UCO Bank, industry observers are keen to see if the institution re-evaluates its decision pending the growing scrutiny over its implications on employee rights. Will the bank recalibrate its approach, respecting statutory rights while meeting operational goals? The balance struck could set a precedent for other financial institutions facing similar pressures.

With impending profitability goals and mounting pressure to perform, UCO Bank stands at a crossroads. The outcome of this circular could either strengthen the bank’s resolve to maintain profitability through rigorous staff management or lead it to reconsider its stance in favor of fostering a healthy, supportive work environment. Either way, this significant decision is poised to affect not just current employees but the broader landscape of labor relations within the Indian banking sector.

Bankerpedia’s Insight 💡

UCO Bank’s decision to suspend employee leave until September 30, 2025, raises significant concerns in India’s banking sector, reflecting a critical tension between operational demands and employee rights. The circular undermines statutory leave entitlements, potentially breaching established legal protections and jeopardizing workforce morale. As the festive season approaches, this move could further alienate employees, risking discontent and productivity issues. Stakeholders should advocate for a balance that honors employee welfare while meeting operational goals. It’s crucial for workers to stay informed about their rights and for banks to prioritize sustainable employee relations.

How Does This Affect the Banking Ecosystem? 🏦

- Bank Employees → Leave rights restricted, increasing employee discontent and uncertainty.

- Bank Management → Legal scrutiny may challenge management’s operational decisions.

- Bank Customers → Reduced staff availability may impact customer service negatively.

- Investors / Shareholders → Potential legal challenges could jeopardize UCO Bank’s profitability.

- Regulators (RBI, SEBI, Govt.) → Regulators may intensify scrutiny on labor rights compliance.

- General Public → Employee leave rights may be compromised, raising concerns.

Research References 📚

Loved our Research? ❤️

Bankerpedia turns financial confusion into clarity!

Subscribe to our YouTube channel for unbiased insights, financial literacy & practical banking wisdom.